Introduction — Why Early Trend Detection Defines TikTok Shop Success

TikTok Shop has created a new kind of commerce ecosystem—where demand is shaped in real time by creators and content. Products rise, peak, and decline faster than on any other e-commerce platform. Supply chains, marketing strategies, and seller decisions now depend on one core skill:

👉 Spot breakout products early, during the 0–1000-order window — before the competition notices them.

However, early signals are noisy. Some products spike from one viral video then disappear. Others grow steadily and become 5K–15K order winners. To succeed, sellers must understand the patterns, behaviors, and market indicators behind early-stage traction.

This guide provides a complete data-driven approach to identifying those early winners — based on thousands of real product journeys across TikTok Shop.

Executive Summary — What You’ll Learn in This Guide

What early winners look like

- Predictable initial velocity

- Micro-creator involvement

- Rising category momentum

- Reasonable price anchoring

- High-repeatability content

How to evaluate early trend signals

- Category volatility

- Cross-region movement (U.S. → UK → U.S.)

- Competitive density

- Creator-to-product lift

- Content format virality

Repeated patterns among breakout SKUs

- Micro-creator momentum waves

- Seasonal triggers

- U.S.–UK echo trends

Action steps for sellers

- Daily monitoring

- Creator-led research workflows

- Pricing and listing strategy

- Competitive validation

Where FastMoss helps

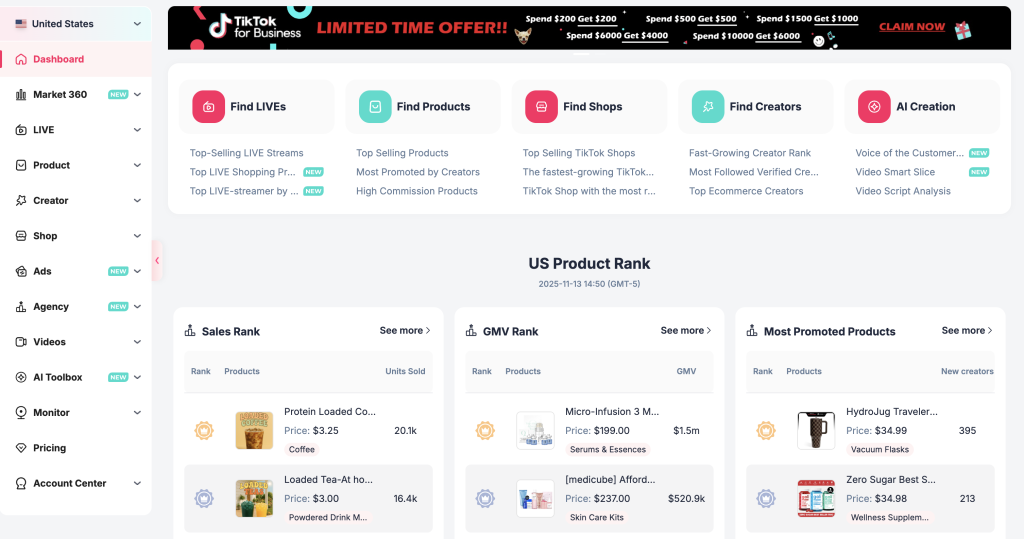

After we deliver insights, we’ll show how tools like FastMoss simplify early-stage trend discovery — with links to specific modules.

Market Trends — Why TikTok Shop Is Built for Early Movers

To identify early-stage winners, you must understand the macro trends shaping the platform.

Product Lifecycles Are Shorter — but More Predictable

A typical TikTok Shop lifecycle looks like this:

- 0–100 orders: Early discovery

- 100–1000 orders: Warm momentum

- 1K–10K orders: Viral acceleration

- 10K+ orders: Saturation & decline

The 100–1000 stage is where the highest ROI opportunities appear — and the point where identifying patterns becomes critical.

Category Volatility Creates Endless Openings

Category leaders can change weekly. The categories most likely to produce early winners:

- Beauty & skincare

- Kitchen tools

- Home improvement

- Cleaning & organization

- Apparel basics

- Personal care

These categories have high content velocity and strong “TikTok-able” storytelling potential.

Creators Are the Earliest Indicators of Market Demand

Creators drive product movement first — orders follow later.

Micro creators (5K–50K followers) are especially important, because they:

- Convert at the highest rates

- Test products early

- Drive consistent daily velocity

- Produce authentic, repeatable content

Understanding micro-creator activity is central to detecting early product momentum

Deep-Dive: The Key Signals Behind 0–1000 Order Winners

Below are the seven most reliable signals used by top sellers and agencies.

Signal #1 — Early Velocity Curves (The Top Predictor)

Early winners show consistent, not explosive, daily growth.

Healthy trajectory example:

- Day 1 → 15 orders

- Day 2 → 22 orders

- Day 3 → 35 orders

- Day 4 → 48 orders

- Day 5–7 → stable upward curve

Unhealthy trajectory example:

- Day 1 → 120 orders (single viral spike)

- Day 2 → 4 orders

- Day 3 → 0

You’re looking for repeatable demand, not accidental virality.

Signal #2 — Category Entry Points & Micro-Trends

Products that break out early usually originate in:

- Emerging subcategories

- Problem-solving niches

- Search-friendly categories

- Gaps where listings are outdated or weak

Examples:

Beauty: lip oils, hair bonding, lash care

Kitchen: storage solutions, mini appliances

Home: LED tools, cleaning gadgets

The sweet spot is: rising demand + low competition + strong visual storytelling.

Signal #3 — Competitive Density & Differentiation

Avoid saturated product spaces unless you have:

- A unique bundle

- New variant

- Better pricing

- Stronger creator support

- A viral content angle

The best early-stage winners typically launch in niches with <10 direct competitors.

Signal #4 — Creator Momentum (Most Underrated)

Creators signal trends before sales data does.

Positive signs:

- 2–5 micro creators post within 72 hours

- High comment rate

- Strong audience alignment

- Unique content angles

- Organic engagement, not sponsored scripts

Negative signs:

- One large creator driving a one-time spike

- Generic ad-like videos

- No comments indicating demand (“I need this,” “Where link?”)

Creators validate future demand, not current orders.

Signal #5 — Content Repeatability & Visual Impact

Winning products share traits like:

- Clear demo

- Viral hook in 3 seconds

- Transformation moment

- ASMR / sensory appeal

- Story or challenge format possibilities

If 20 different creators can make videos with different angles → it can scale.

Signal #6 — Pricing Strategy

Early winners typically fall into the $6.99–$24.99 range.

Winning early strategies include:

- Intro pricing

- Bundling

- Tiered variants

- Slight undercut of category average

Pricing should reduce friction, not maximize margin (yet).

Signal #7 — Cross-Market Echo Trends (U.S. ↔ UK Only)

Important Update: Since SG data is not available, cross-market prediction currently focuses on U.S.–UK behavior only.

Breakout patterns often follow this sequence: UK → U.S. (most common) U.S. → UK (beauty & cleaning categories)

If a SKU is gaining traction in the UK and begins showing early U.S. activity (20–50 orders), it’s usually a strong signal.

Pattern Analysis — Examples of Early Winners

Here are expanded versions of the 3 most common breakout patterns.

Pattern A — The Micro-Creator Momentum Wave

- 4–7 micro creators post within 72 hours

- Orders grow consistently, not explosively

- Price point = under $15

- Category = beauty, kitchen, home

- Audience = highly comment-driven

- Order trajectory = smooth upward curve

These SKUs often hit 5K–15K orders in 4–6 weeks.

Pro Tip: Validate This Pattern Instantly Using FastMoss Creator Search

You can combine creator filters in the FastMoss Creator Search Engine to spot this pattern in real time:

- Creator Size: 5K–50K

- Content Type: Demo / Review

- Product Order Volume: 0–1000

- Post Date: Last 72 hours

Run this combination here: 👉 FastMoss Creator Search https://fastmoss.com/influencer/search?shop_window=1

Pattern B — Seasonal or Event-Triggered Micro-Trends

“Calendar-based” micro-trends can be incredibly predictable:

- Back-to-school

- Holiday décor

- Summer kitchen gadgets

- Valentine’s beauty products

- Winter home improvement

These categories have rapid early growth and low early competition.

Pattern C — Cross-Market Echo Products (U.S.–UK)

Products often break out in one TikTok Shop market before echoing into the other.

Updated behavior (no SG):

- UK sees early traction → U.S. follows within 2–10 days

- U.S. viral items → UK creators pick up within 1–2 weeks

🔍 Pro Tip: Track U.S.–UK Cross-Market Signals in FastMoss

Use the Product Trends Explorer to see rising items in both regions and detect echo patterns early: 👉 FastMoss Product Trends (U.S.) https://fastmoss.com/e-commerce/saleslist?region=US

What Sellers Should Do in the Next 30–90 Days

Here’s how to turn patterns into a repeatable operating system.

Step 1 — Monitor categories daily

Trends move too fast for weekly check-ins.

Step 2 — Track creators, not just products

Creators show demand shifts days before order data reflects it.

Step 3 — Validate Competition Early

Before entering a niche, check:

- Number of sellers

- Listing quality

- Variant availability

- Pricing gaps

- Review velocity

🔍 Pro Tip: Use FastMoss Product Search to Analyze Competitor Density

You can filter by category, pricing, rating, or variant to understand competition: 👉 FastMoss Product Search (U.S.) https://fastmoss.com/e-commerce/search?region=US

Step 4 — Prepare supply ahead of time

Once a SKU hits 300–500 orders with rising creator activity, competition accelerates quickly.

Step 5 — Apply a content-led launch strategy

Your hero video and creator angle matter more than listing optimization in early days.

Step 6 — Adopt a rapid testing & iteration cycle

Test:

- Hooks

- Price points

- Bundles

- Variants

- Creator niches

🔍 Pro Tip: Use FastMoss to Benchmark Which Creators, Prices, & Variants Are Winning

Trend curves, creator performance, and listing data update multiple times daily in FastMoss: 👉 https://fastmoss.com/e-commerce/saleslist?region=US

Why These Insights Matter

The signals in this guide come from analyzing thousands of TikTok Shop product journeys across the U.S. and UK. These behaviors repeat because the platform is built on:

- creator influence

- short video formats

- social proof loops

- rapid consumer response

Identifying early winners is not luck — it’s pattern recognition.

How FastMoss Helps You Spot 0–1000 Order Winners

FastMoss is built for exactly this type of early detection.

With FastMoss, sellers can:

✔ Identify early breakout products

✔ Track micro-creator movement

✔ Analyze competitors & category saturation

✔ View historical velocity curves

https://www.fastmoss.com/dashboard?refCode=PC0384

✔ Monitor U.S.–UK cross-market signals

https://www.fastmoss.com/dashboard?refCode=PC0384

Stay Ahead of the Next Breakout Trend

If you want to analyze TikTok Shop trends, identify 0–1000 order winners early, and track creator-driven momentum:

Stay ahead of the next breakout before the rest of the market catches on.