On June 30, 2025, TikTok Shop officially launched in Japan, becoming the platform’s 17th global e-commerce site. In less than 30 days, it generated over $15 million USD in total sales, with beauty and personal care products accounting for 32% of the GMV.

FastMoss is the first platform to provide real-time TikTok Shop Japan data, and our analytics reveal what’s driving this explosive growth.

The Japanese Market: High Value, Low Saturation

TikTok’s Japanese user base is massive:

30 million+ monthly active users

96 minutes of daily average usage (more than YouTube or Instagram)

Japan’s e-commerce penetration is under 10%, and livestream shopping adoption remains around 5%—leaving enormous room for growth.

With a per capita GDP of over $30,000 and strong consumer spending power, Japan is a high-AOV market ideal for global expansion.

TikTok Shop’s merchant onboarding also enables fast entry without domestic corporate registration, making Japan an open door for cross-border commerce.

Category Trends: Beauty Dominates, Tech & Toys Rise Fast

According to FastMoss data, four categories led early growth:

Beauty & Personal Care

Mobile Accessories & Electronics

Fashion Accessories

Kitchen & Home

But in the most recent week, mobile accessories surged to #1, followed by beauty, then toys.

Key Breakouts:

Mobile Accessories

Driven by Japan’s robust secondhand smartphone market. Hot sellers include MagSafe kits, screen repair tools, and “blind box” cable bundles.

Beauty

Waterproof powders, herbal skincare, and cosplay kits are topping the charts. Localized video content (like hot spring tests) is driving trust and conversions.

Toys & Hobby

From Pokémon card livestreams to 1:100 Shinkansen model kits, niche items are benefiting from Japan’s collector culture.

The Conversion Engine: How Japanese Shoppers Buy on TikTok

FastMoss identifies three major conversion drivers:

1. Product Cards

Quiet but powerful. Over 80% of some top sellers’ conversions came from product card browsing—especially effective for visually striking or highly functional products.

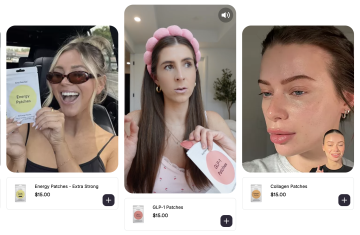

2. Creator Marketing

Top brands collaborated with 200+ local creators to drive trust-based sales. Japan’s viewers prefer realism over hype—subtle lifestyle demos far outperform flashy slogans.

3. Scenario-Based Content

Videos that demonstrate how a product solves a real problem (storage, skincare, etc.) consistently outperform generic promos. Example: waterproof powder tested in hot springs.

Operational Challenges: From Compliance to Localization

As competition heats up, operational readiness separates winners from everyone else.

IP Compliance

Merchants must align account IPs with declared shop regions to avoid restriction. Solutions like browser isolation tools are helping sellers stay compliant.

Customer Service

Lack of Japanese-language support caused over 60% inquiry drop-offs. Stores offering next-day delivery saw 30% lower return rates.

Localization Details

From minimalist eco-packaging to allergy labeling and seasonal design cues—Japanese buyers value thoughtfulness, not flash.

Final Takeaway: The Real TikTok Opportunity in Japan

As FastMoss shows, Japan is not about price wars. It’s about:

Localized storytelling

Functional product design

Trust-based influencer marketing

Smart optimization using real-time data

The $15M GMV in one month proves TikTok Shop’s content-commerce model is working globally—and Japan may become the most promising market yet.

Want to see what’s trending in Japan’s TikTok Shop?

Visit fastmoss.com for real-time dashboards, category charts, and campaign benchmarks — and get 15 days of free trial to explore all the insights firsthand.