In a year marked by structural shifts in content-driven commerce, TikTok Shop is rapidly redefining global consumer behavior. To help brands navigate this new terrain, the FastMoss Research Institute has released the “2025 Mid-Year TikTok Shop Analytics Research Report”—an in-depth white paper capturing key insights, performance trends, and emerging strategies from the first half of 2025.

This is not just a report. It’s a strategic roadmap built for businesses looking to scale on TikTok Shop—whether in the U.S., Europe, Southeast Asia, or emerging Spanish-speaking markets.

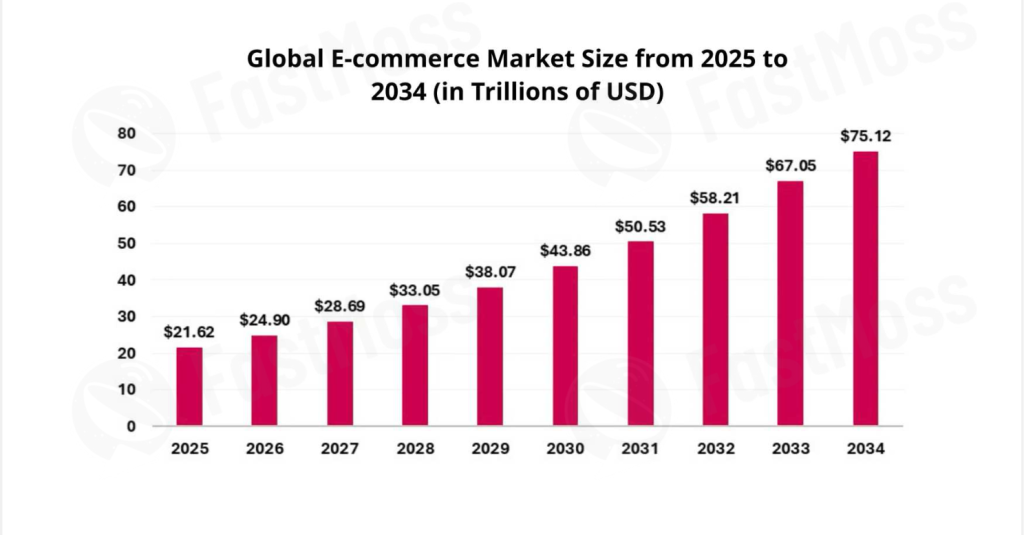

A Glimpse Into the Future of Global Commerce

TikTok Shop is no longer just a sales channel—it is becoming “the new business arena” for global brands. The white paper analyzes the platform from multiple dimensions, including:

- Core platform data from H1 2025

- Livestream commerce trends

- Product performance and bestseller rankings

- Creator ecosystem analysis

- Advertising effectiveness and media buying insights

- Agency performance benchmarks

- Ecosystem evolution and opportunity mapping

Uniquely, this report features first-hand interviews with top-performing TikTok brands and creators across key regions. These include Goli (Top 1 health supplement brand in the U.S.), Cata-Kor (a viral product success), and Sk8bord B (a leading U.S. creator), offering grounded insights for anyone aiming to compete on the platform.

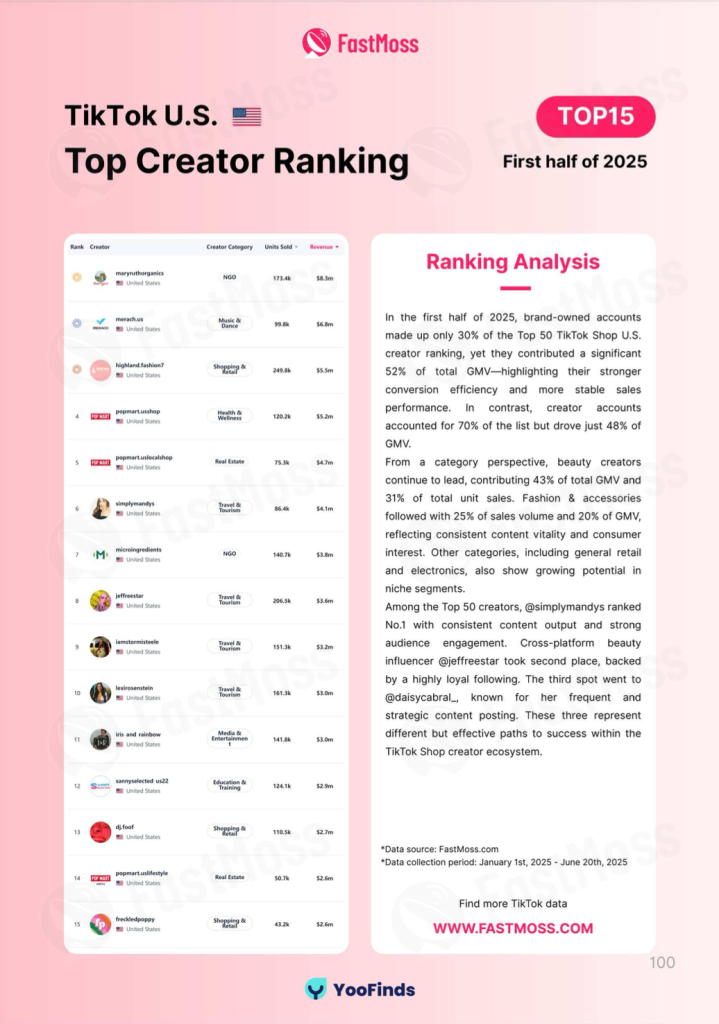

U.S. Market: From Influencer-Led to Brand-Owned Channels

In the U.S., TikTok Shop is undergoing a significant shift—brands are now leading the charge. Merchant-led livestreams have gained traction, replacing an earlier reliance on influencer partnerships. Brands are prioritizing:

- Building first-party audiences via official TikTok accounts

- Crafting content aligned with brand values

- Gaining better control over conversion flows

Exclusive interviews in the report feature U.S. leaders like MaryRuth’s (health category), Goli, and Social Army (top-tier MCN), offering a playbook for brands entering or scaling in the U.S. TikTok ecosystem.

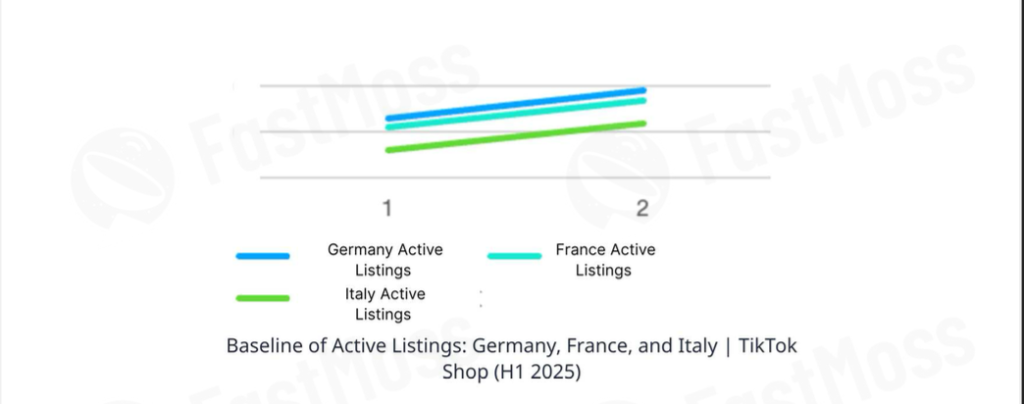

Europe: Category Specialization and Brand Storytelling Take the Lead

Europe presents a fragmented but maturing landscape. The dominant trend? Brand-led livestreaming and strong category differentiation. Highlights include:

- Beauty and personal care excelling in the UK and Germany

- Collectibles surging in Germany, fueled by IP-driven demand

- Fashion accessories dominating Italy and France

- High cultural premium pricing strategies seen in niche categories like fragrance (e.g., APRIZO)

The report breaks down Europe’s “brand-first, category-focused” approach and offers insight into how localization and cultural storytelling power sustainable market entry.

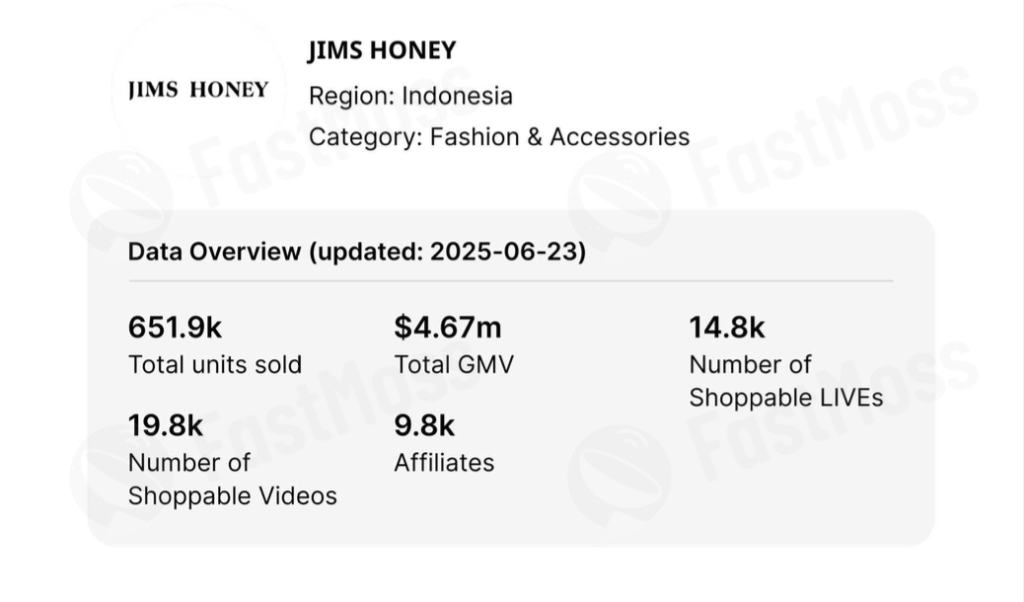

Southeast Asia: Creator Economy Thrives, Beauty & Electronics Dominate

TikTok Shop in Southeast Asia is booming—with Indonesia (30%), Philippines (27%), and Malaysia (22%) forming the core livestream commerce hubs in the region.

While creator-led commerce still dominates, brands are ramping up their presence. Southeast Asia showcases:

- Deep cultural integration through local creators and micro-influencers

- Fast-growing product verticals in beauty and electronics

- High demand for content-to-conversion optimization

From JIMS HONEY’s local brand narrative in Indonesia to Judydoll’s success in Vietnam’s “affordable luxury” space, the report details actionable, culturally tailored strategies for regional growth.

Spanish-Speaking Markets: 90%+ of Sales Driven by Brand-Owned Streams

TikTok Shop is gaining momentum in Spanish-speaking regions, especially Brazil, Mexico, and Spain, where brand-operated livestreams have become the mainstream, accounting for:

- 92% of GMV in Brazil

- 82% in Spain

- 70% in Mexico

This trend underscores a strategic shift: livestreaming is no longer a quick-hit tactic but a long-term brand-building channel. Brands are investing in localized content, verticalized operations, and structured customer engagement.

What Sets This Report Apart

The FastMoss TikTok Shop White Paper is the only Chinese-language industry report featuring in-depth global case studies and brand interviews from the frontlines of TikTok commerce. It is built not to just inform—but to guide decision-makers on:

- Where to allocate resources across markets

- How to evolve from influencer dependence to full-stack brand operations

- How to structure teams, campaigns, and content for scalable success

From Traffic to Assets: The New Growth Mindset

The playbook for TikTok Shop success in 2025 is changing:

- Content = Commerce Entry Point

- Livestreams = Transaction Hubs

- Short videos = Consumer Trust Builders

Gone are the days of chasing viral spikes. The new growth strategy is about building asset-based momentum—where content creates brand equity, not just clicks.

Download the Report

📥 Get the full FastMoss 2025 Mid-Year TikTok Shop White Paper

Start planning your Q4 campaigns with actionable insights, category forecasts, and region-specific strategies.

Ready to turn TikTok Shop insights into real business results?

Now’s the perfect time to upgrade your toolkit.

Use code PC0384 at checkout to get 15% off your FastMoss Pro subscription.

✔ Unlock full access to TikTok Shop seller & creator analytics

✔ Monitor trends across global markets in real-time

✔ Make smarter decisions with FastMoss’s AI-powered intelligence platform